The economic impact of the 'tariff chaos'

United States of America (USA) and World Trade

A complex collaboration of economic, political, and environmental factors shapes the environment of the world trade, and it is the same for United States and global trade. According to the perspective of Trump's administration, tariffs will encourage consumers to buy more American-made goods, increase tax revenue, lead to significant levels of investment, and reduce the gap between the value of goods the US imports from other countries and those it exports to them (BBC,2025). Therefore, they impose a 44% tariff on Sri Lanka to reduce the trade deficit with them. On the other hand, the United States of America has been a member of the World Trade Organization (WTO) since January 1, 1995, and a member of the General Agreement on Tariffs and Trade (GATT) since January 1, 1948. The United States member profile on the WTO website includes trade and tariff profile, trade policy reviews, regional trade agreements, dispute cases and more. (WTO,2024). According to their global trade volume, the United States owns in 2022 the world's second-largest trading nation, with over $7.0 trillion in exports and imports of goods and services (U.S. Census Bureau and the U.S. Bureau of Economic Analysis,2025). So, Sri Lanka needs to understand how the US market impacts us to leverage our export earnings in the international market. However, imposing this reciprocal tariff causes Chao’s in trade. Because most of the developed nations, like China, export their massive number of goods and services to the US market. Tariff rates for their goods and services are more costly than the domestic goods and services, and it naturally leads to discouraging imported products in the US market. Finally, it causes to encourages domestic producers to increase their production volumes in the market. This strategy helps them to enhance the number of job opportunities in domestic industries, increase government Revenue, and Encouragement of Import Substitution. However, it causes Reduced Export Demand, Trade Diversion, Economic Slowdown in Export Industries, Long-Term Structural Changes, and Exchange Rate Pressures in the exporting country. As a result of these consequences, consumers and producers in any country want to understand the market mechanism behind the tariff.

What is a Tariff?

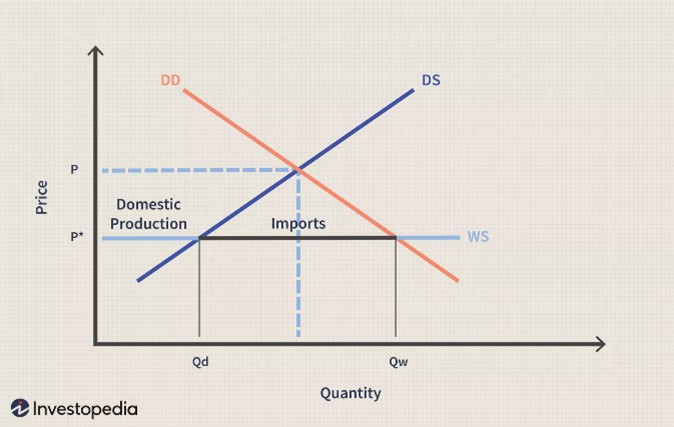

According to the World Trade Organization, customs duties on merchandise imports are called tariffs. It gives price advantages to the countries' locally produced goods over similar goods which are imported from other countries, and it impacts to raise revenue for the government. Tariffs increase the price of imported goods, and it cause to cheaper the domestic producers' products in the market it and reducing efficiency by allowing companies that would not exist in a more competitive market to remain open. figure one and two clearly identify this scenario as simple. In the figure one illustrates the effects of world trade without the presence of a tariff.

Figure 1 : World trade without tariff

Figure 2 : World trade with tariff

In graph 1, DS means domestic supply, and DD means domestic demand. The price of goods at home is found at P, and the world price is found at P*. At P*, consumers will consume Qw amount of goods because the home country can only produce up to Qd at that price. As a result of that Qw-Qd amount of goods wants to satisfy the consumers' wants in the country. However, this kind of consumer behaviour leads to the loss of confidence in the domestic producers and highly affects the decrease of the country's domestic production. In this kind of scenario government intervention in the economy and imposes tariffs on imported goods to protect the domestic producers in the country. In Figure 2 price increases from the non-tariff P* to P'. Because the price has increased, more domestic companies are willing to produce the good, so Qd moves right. This also shifts Qw left. The overall effect is a reduction in imports, increased domestic production, and higher consumer prices. It means that increasing the producers’ surplus by the same amount of a loss gains the consumers in the country. According to the trump administration, they clearly define that they want to increase their domestic production and increase the wealth of the nation. This kind of scenario highly affects the consumer patterns in a capitalist country like the United States. On the other hand, it highly affects emerging countries that create their main export destination to the developed countries.

Does that Bargaining Power Influence Tariff Levels and implications to Sri Lankan economy According to the policy analysis, a country's bargaining power influences the terms and conditions of a deal in its favour. A country with a larger market, diverse exports, or strong alliances possesses greater bargaining power. In the current global scenario, the United States under the Trump administration used reciprocal tariffs to pressure countries into negotiating trade deals by leveraging its large market. Simply put, a small economy like Sri Lanka has weaker bargaining power due to its heavy reliance on a few export markets and limited influence in global trade negotiations, which leads to increased pressure from these tariffs. Furthermore, regarding Washington D.C., they impose a 44% tariff despite our significant trade deficit with them. According to statistics, Sri Lanka's exports are USD 2,909.97 Mn and imports are USD 443.90 Mn from the United States (Sri Lanka Export Development Board, 2024). Additionally, Sri Lanka’s exports to the United States increased by 5% in 2024 compared to 2023, while imports from the United States decreased by 13% in 2024 compared to 2023. Compared to this disadvantageous situation with the United States, they impose a 44% reciprocal tariff on Sri Lankan exports. Thus, the Trump administration strategically employed the U.S.'s market power to enforce reciprocal tariffs, seeking to rebalance trade relationships. According to Ulrich von Schwerin (2025), Trump suspended the tariff for 90 days to postpone a potential economic crisis in the world. If the tariff is imposed as announced, Sri Lanka will not only face a crisis in textile exports but also broader threats to its economic recovery. However, this ripple effect impacts our country because the U.S.-China trade war initiated by Trump had a cascading effect across global markets. Sri Lanka, while not a direct target, experienced several consequences such as demand shocks, rupee depreciation, a slowdown in foreign investment, GSP programme uncertainty, and trade vulnerabilities. Sri Lanka’s experience illustrates how small economies often suffer collateral damage in great power trade conflicts. This underscores the importance of economic diversification, strategic diplomacy, and resilient trade frameworks to future-proof the economy.

H.W. Thisuri Jayathma is an Intern [Research] at the Institute of National Security Studies think tank, established and functioning under the Ministry of Defence. The opinions expressed are her own and not necessarily reflective of the Institute or the Ministry