by Wing Commander Udith Pathirana

Published on Ceylon Today on 05th September 2023

Introduction

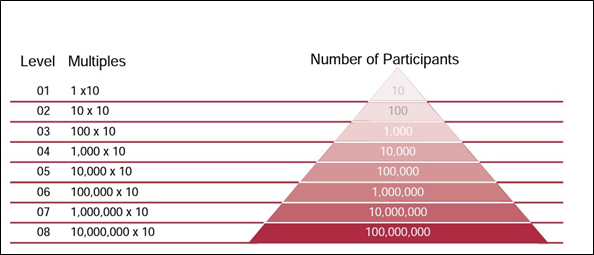

Source: Pamphlet Series 4, Danger Posed by Pyramid Schemes & Network Marketing Programs published by the Central Bank of Sri Lanka in the year 2006.

A pyramid scheme constitutes a deceitful strategy for generating monetary gains, hinging upon the recruitment of an expanding group of "investors". Initially, promoters attract individuals to become investors, who subsequently draw in additional participants, perpetuating the cycle. Sri Lankan Central Bank (CBSL) has prohibited pyramid schemes by issuing a red notice to the general public on 24 August 2023 by highlighting companies that were identified as pyramid schemes (CBSL, 2023). Accordingly, the undermentioned entities/companies/money schemes were indicated by the CBSL.

It was evident that these illegal entities were actively promoting their illicit business through both public and social media platforms. Unfortunately, it was evident that the MTFE sponsored a team in the Cricket Team in the Sri Lankan Premier League (SLPL) (SL MIRROR, 2023). In the past, these prohibited illicit entities used psychological manipulation to entice individuals to join its network by promising rewards or benefits in exchange for recruiting new members, rather than offering legitimate investment opportunities or engaging in the sale of goods. Moreover, they employed deceptive tactics, including false claims about processes such as reinvestment, partnerships with foreign firms, and investment security through insurance schemes, all of which attracted a significant number of unsuspecting individuals.

Furthermore, these pyramid businesses have exploited the power of social media activities, public sponsorships, and social events to greatly enhance their recruitment efforts. At present, there exists a multitude of victims in Sri Lanka who have suffered financial losses due to the fraudulent activities of the aforementioned institutions. In contrast, only a small fraction of participants managed to accumulate substantial wealth through the same pyramid scheme. Despite the recurring nature of these frauds in Sri Lanka, only a few responsible individuals have faced legal action leading to the confiscation of assets in recent times (FATF APG, 2015, 2019, 2021). This lack of prosecution unquestionably contributes to the escalation of financial crimes, perpetuating a cycle of creating new variations of pyramid schemes.

Existing Problem

Illegal pyramid businesses such as OnmaxDT and MTFE were proven to have financial transactions, collections and gains of over a billion Sri Lankan rupees which were transformed through both banking and non-banking mechanisms. Further, the Daily Mirror Eye Investigation report published on 22 September 2021 comprehensively underscores the severe loopholes in the financial crime prevention mechanism of Sri Lanka where even having identified suspicious transactions reports (STR) raised by the Banking Sector in year 2008 against the Best Life International (Pvt) Ltd, they were continued to expand their business until 2016 without having any direction of termination of the account which the same bank has to file the second STR in 2016 (Fonseka, 2021). Nevertheless, since the submission of the STR, respective legal authorities have failed to take prompt and adequate actions such as prosecutions and confiscations against the perpetrators of the Best Life International (Pvt) Ltd up to date.

Recently, Sri Lanka has enforced a ban on pyramid schemes, which function as a business model by enticing individuals with promises of compensation or services in exchange for enlisting others into the scheme, rather than engaging in legitimate investment activities or product sales. However, it has become evident that a significant number of financial transactions have been routed through Sri Lanka's established banking system, which unfortunately failed to discern the origins of these funds and their ultimate destinations. Ethically speaking, this scenario has paved the way for instances of money laundering (ML), resulting in the illicit movement of funds to their intended endpoints. Consequently, the implementation of legal measures against financial crimes within Sri Lanka has been notably delayed, leaving the general populace exposed and susceptible to victimization.

Discussion

The exposure of Sri Lankan pyramid schemes and the deficiencies within the countermeasures, as highlighted by Fonseka (2021), provides a comprehensive account of the ineffectiveness inherent in our financial apparatus. Furthermore, the proceeds and illicit activities stemming from these schemes have given rise to enduring financial and societal predicaments for the broader populace, while only a select few reap the utmost rewards, enabling them to indulge in lives of opulence. Compounding the issue, the pursuit of legal remedies has been significantly delayed by the prevailing mechanism resulting in the enhancement of its network and assets base. In some instances, the attribution of accountability for these actions remains vague, contributing to a cycle of deferral as responsibility is shifted from one party to another such as Banks, CBSL and Legislative Authorities (Fonseka, 2021).

Additionally, pyramid schemes tend to disguise their activities, often presenting themselves as legitimate business ventures. As a result, they might not raise the same red flags that are typically associated with more overt forms of financial fraud. Their deceptive nature can make it challenging for banks to detect these activities solely through transaction monitoring. Moreover, the funds involved in pyramid schemes might not flow exclusively through traditional bank accounts where those actions might use various channels, including cash transactions and informal payment methods, further complicating the detection process within the confines of conventional banking oversight. However, leaving the identified cases unattended or delayed in legal actions would create numerous financial and social issues.

Importantly, a comprehensive in-depth analysis would reveal that a major portion of these instances can be linked to a select group of recurrent actors who have transformed such activities into their primary income source, allowing them to lead opulent lives through the illicit acquisition of hard-earned money from victimized individuals. Despite the presence of an array of legal statutes and segments in Sri Lanka designed to prosecute and probe such illicit undertakings, the unfortunate reality is that the growing trend in such activities highlights the inefficacy of the entire system, which ultimately favours the perpetrators to loot the hard-earned money of innocent citizens. Nonetheless, it is unbelievable that pyramid businesses are functioning under the established financial network of Sri Lanka during a situation where CBSL has banned the use of cryptocurrencies.

OnmaxDT has proven to be doing transactions since the year 2020 in the Sri Lankan market, but the legal mechanism has failed to curtail or ban the particular illicit business until the end of 2022 (Hettiarachchi, 2022). Instead, pyramid schemes rely on recruitment and the flow of funds between participants, which might not be captured by standard banking monitoring mechanisms. Hence, MTFE has reached its hands to the level of publishing and sponsoring SLPL demonstrating the actual financial audition of the nation which does not inquire about the legitimacy of the source of funds generated during transactions, sponsoring, and publishing.

Most unfortunately, the Sri Lankan anti-corruption mechanism has failed to secure the general public from the criminal activities performed by these illegal businesses. Further, the illegal funds acquired through these means serve as a resource for criminals to evade legal proceedings or even abscond from the country with their unlawfully obtained gains, employing diverse methods of ML for this purpose. Nonetheless, delaying legal actions, lack of prosecution and delayed confiscation would cause the government to cause barriers to the asset recovery of victims which ultimately becomes a social issue that could affect the national security.

The predominant composition of pyramid groups largely comprises individuals positioned at the bottom of the socioeconomic hierarchy. Regrettably, they face a dearth of opportunities to engage with banking institutions and fundamental financial services, primarily due to poverty and limited knowledge of the financial activities of the globe. Nonetheless, the development of the mobile industry has offered an opportunity to extend both social and financial services utilising mobile networks which is invariably beneficial to expanding pyramid businesses (Sultana, 2009). Further, CBSL in a statement reminded the general public “Participating in a pyramid scheme is a punishable offence” which has made victims be threatened by the pyramid perpetrators to refrain from filing complaints against the particular agents. As a result, victimised personnel would find themselves trapped in a condition where recovering diligently earned capital becomes an insoluble challenge that leads to significant social problems such as economic instability, increased inequality, diminished trust in financial systems, and financial imbalance in domestic life.

Therefore, addressing this social issue is deemed necessary by direct involvement of the government which would ultimately affect the national security of Sri Lanka. Overall, conventional financial traces are less in pyramid schemes that are considered to be complex in nature which makes it difficult to identify solely through traditional banking mechanisms. Therefore, addressing such issues might require a more holistic approach that involves governing agencies, law enforcement, public awareness campaigns at the mass level, and fostering effective collaboration among various stakeholders of the legal and financial sectors that would shield the general public from the perils of pyramid schemes while promoting a secured financial landscape.

Way Forward

Fighting against pyramid schemes requires a concerted effort from all sectors of society. Therefore, implementing the undermentioned recommendations could aid in mitigating the negative impact of pyramid schemes by protecting the public and preserving the integrity of the financial sector of the nation.

Strengthen the Legal Framework.

Establish a dedicated mechanism to swiftly prosecute and penalise individuals and entities engaged in pyramid schemes. Further, it requires speeding up cases associated with pyramid schemes to ensure swifter justice for victims and discourage perpetrators.

Effective Regulatory Oversight.

Cooperate with worldwide financial regulatory bodies to learn from best practices and augment cross-border cooperation in recognising and tackling pyramid schemes.

Heightened Public Awareness.

Launch widespread awareness campaigns with the involvement of mass media to educate the general public about pyramid schemes and the probable risks of investing.

Strict Source-of-Funds Verification.

Impose severe Know Your Customer (KYC) and source-of-funds verification requirements for all financial activities counting sponsorships and propaganda to prevent the legitimization of illicit gains.

Swift Confiscation of Assets.

Streamline the procedure for the swift confiscation of assets acquired through pyramid schemes to demotivate perpetrators and preserve financial integrity.

Continuous Monitoring and Adaptation.

Continuously monitor the growing tactics of pyramid schemes and adapt governing and legal tactics following new schemes.

Link to the original source : Click here

* Wing Commander Udith Pathirana is a Military Research Officer at the Institute of National Security Studies (INSS), the premier think tank on National Security established under the Ministry of Defence. The opinions expressed are his own and not necessarily reflective of the institute or the Ministry of Defence.